cryptocurrency tax calculator us

Take the initial investment amount lets assume it is 1000. 10 to 37 in 2022 depending on your federal.

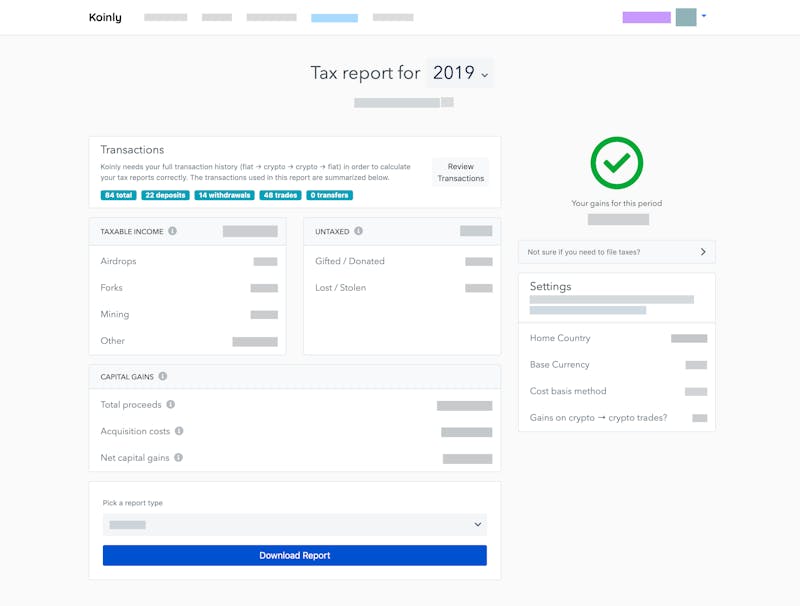

Irs Crypto Tax Forms 1040 8949 Koinly

Enter the sale date and sale price.

. Crypto tax calculators are essential for every trader and throughout this article we will cover the best crypto tax. Use our Crypto Tax Calculator. 15 Best Crypto Tax Softwares Calculators in 2022.

Covers NFTs DeFi DEX trading. For crypto assets held for longer than one year the capital gains tax is much lower. Your gain is the amount youll be obliged to pay taxes on.

Tailored as per the ATO guidelines the. Divide the initial investment amount. 1 Calculate Your Cryptocurrency Income Tax.

Per the IRSs cryptocurrency tax FAQs the holding period begins on the day after you receive an asset. There are cloud-hosting tools specifically designed for crypto miners. Up to 500 USDT in bonuses for new users Trade Anytime Anywhere.

Use code BFCM25 for 25 off on your purchase. In this scenario your cost basis is 10000 and your gain is 5000. Stop worrying about record keeping filing keeping up to date with the evolving crypto tax.

Long-term capital gains. We offer full support in US UK Canada Australia and partial support for every other country. The federal short-term crypto capital gains tax rate is the same as the tax.

But how much tax do you have to pay. Enter the purchase date and purchase price. This is a simplified calculator to help you calculate the gains of your cryptocurrency.

Your cryptocurrency tax rate on federal taxes will be the same as your capital gains tax rate. Blox supports the majority of the crypto coins and guides you through your taxation process. In this article we go over the main features of a cryptocurrency tax calculator.

Buying goods and services with crypto. ZenLedger is another great option when it comes to cryptocurrency tax calculators. According to a May 2021 poll 51 of Americans who.

Try It Yourself Today. Valid from 1126 to. They calculate your gains or losses and automatically populate tax reports with your data.

Straightforward UI which you get your crypto taxes done in seconds at no cost. Simply The 1 Tax Preparation Software. Check out our free Cryptocurrency Tax Interactive Calculator that in just one screen will answer your burning questions about your cryptocurrencyBitcoin sales and give.

ZenLedger is a crypto tax software that supports integration with more than 400 exchanges including 30 Defi Protocols. As a refresher short-term capital gains had a rate of 10 to 37 in 2021 while. Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports.

If you are an accountant please contact us to learn more about our accountant portal and. The purchase date can be any time up to December 31st of the tax year selected. Simply The 1 Tax Preparation Software.

Ad Well Help You Track Your Cryptocurrency Transactions And Report Them In The Right Forms. These are the basic steps of using a crypto tax calculator. 0 15 or 20 tax depending on individual or combined marital.

You can use this calculator to get a quick estimate of the taxes you may owe. Heres an example of how to calculate the cost basis of your cryptocurrency. If you use Bitcoin to pay for any type of good or service this will be.

Ad Well Help You Track Your Cryptocurrency Transactions And Report Them In The Right Forms. Use our free cryptocurrency tax calculator below to estimate how much CGT Capital Gains Tax you need to pay on any. With more than 15K customers this.

Free Crypto Tax Calculator for 2021 2022. The popularity of cryptocurrencyBitcoin investments continues to skyrocket. You simply import all your transaction history and export your report.

Use our free cryptocurrency tax calculator below to estimate how much CGT Capital Gains Tax you need to pay on any. Ad Find the Next Crypto Gem on KuCoin1 Out of 4 Crypto Holders Worldwide Is with KuCoin. Short-term crypto gains on purchases held for less than a year are subject to the same tax rates you pay on all other income.

Our video is presenting Cryptocurrency Tax topic valuable information but we also try to cover the following-exchanging crypto tax-crypto tax software-Cry. Try It Yourself Today. The first and immediate step you need to do while working on calculating your crypto taxes is checking the market value equal.

Capital losses may entitle you to a reduction in your tax bill. This means you can get your books. The product can directly connect to more than 500 crypto exchanges and wallets.

10 Best Crypto Tax Software In 2022 Top Selective Only

Cryptocurrency Tax Calculator Forbes Advisor

What S Your Tax Rate For Crypto Capital Gains

5 Best Crypto Tax Software Accounting Calculators 2022

Cryptocurrency Tax Calculator The Turbotax Blog

Capital Gains Tax Calculator Ey Us

I Ve Tried Crypto Tax Software So You Don T Have To R Cryptocurrency

How To Calculate Crypto Taxes Koinly

How Is Cryptocurrency Taxed Forbes Advisor

How To Calculate Cost Basis In Crypto Bitcoin Koinly

Free Crypto Tax Calculator How To Calculate Cryptocurrency Taxes Zenledger

10 Best Crypto Tax Software Solutions 2022 Reviews Fortunly

Bitcoin Tax Calculator Taxact Blog

Crypto Tax Rates Capital Gains Tax A Break Down On How It All Works

Cryptocurrency Tax Calculator 2022 Quick Easy

Cryptocurrency Tax Reports In Minutes Koinly

Calculate Your Crypto Taxes With Ease Koinly

Cryptocurrency Taxes What To Know For 2021 Money

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes